It’s no surprise that the iPhone and iPad now form the backbone of Apple’s ecosystem. New data confirms that the Mac, once the company’s flagship, continues to play a supporting role for a smaller slice of customers.

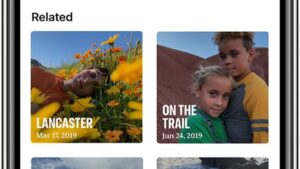

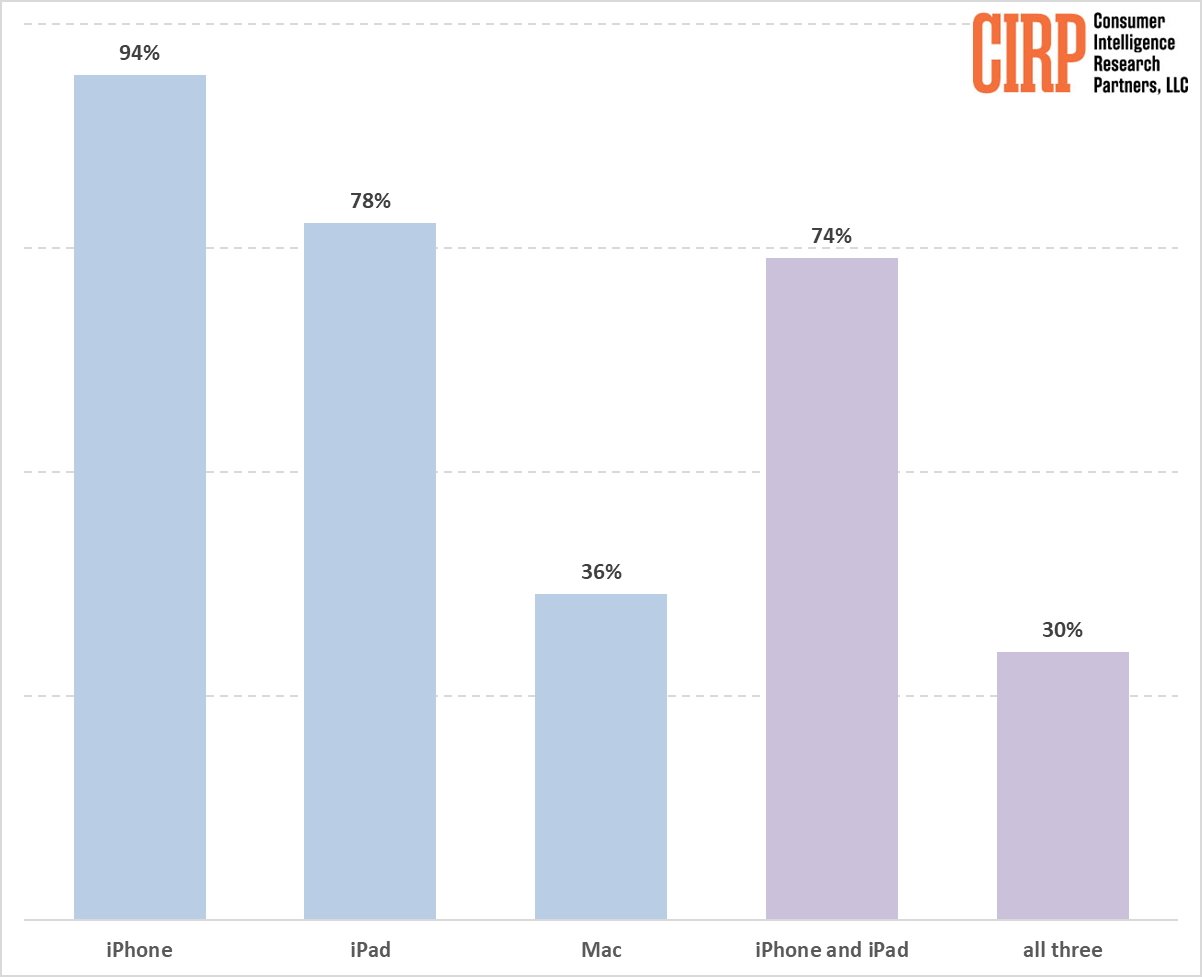

According to the June 4, 2025 Consumer Intelligence Research Partners report titled “Rethinking the Apple Ecosystem,” Apple customers in the 12 months ending in the March 2025 quarter overwhelmingly favored iPhones and iPads over Macs.

- 94% own an iPhone

- 78% own an iPad

- Only 36% own a Mac

- Just 30% own all three

Nearly all iPad users also have an iPhone. But fewer than one in three Apple customers own the full suite.

Macs have fewer owners but punch above their weight in revenue

Once upon a time, Apple’s ecosystem was built around the Mac. The Mac drove iPod sales before the iPod took off on it’s own, and the iPhone had a similar trajectory.

Over time, that dynamic reversed. The iPhone became the dominant platform, and now often stands as a customer’s primary or only Apple device.

The 36% Mac ownership figure is derived from Apple-devout user surveys, but financial data paints a different overall picture. For comparison, iPhone revenue hit $46.84 billion in the same quarter of the survey. Using CIRP’s U.S. average selling price of $971, that suggests Apple sold about 48 million iPhones.

Apple doesn’t publish sales volumes, just dollar-value of each segment. Using IDC’s estimate of 5.5 million Mac shipments in the first quarter and assuming similar shipment levels in the second quarter, the Mac ASP works out to approximately $1,445.

MacBook Pro and MacBook Air account for 86% of Mac sales, with the Pro model alone representing 53%. Desktop Macs like the Mac mini are far less frequently sold, keeping the average selling price up.

That puts CIRP’s 36% ownership figure in a different light, showing how Mac adoption appears larger in surveys than it does in actual sales volumes. Based on sales volume in a quarter heavily biased toward Macs given new releases, there was one Mac sold for every nine iPhones.

Ownership rates among Apple customers in the 12 months ending March 2025. Image credit: CIRP

Amongst other factors, the gap comes from differences in upgrade cycles. People tend to hold on to Macs longer than iPhones, which might make them show up more in ownership surveys even though they sell in much smaller numbers. Still, that doesn’t cover the vast difference in sales volumes.

Even after accounting for the Mac’s higher average selling price, and conservatively favoring Mac sales, the gap is massive. Ownership surveys alone don’t reflect the real difference in product scale or business impact.

Macs serve a narrower but more valuable segment

Unlike the iPhone, which is a daily-use device for nearly every Apple customer, the Mac is often used for more specialized purposes. These include tasks such as professional workloads, software development, and content creation.

Customers in these categories tend to pay more, even if they are fewer in number. Mac longevity also plays a role.

According to CIRP, roughly 68% of Mac owners were still using machines more than two years old. Notably, Apple Silicon Macs shipped in November 2020 — four and a half years ago. And, the COVID sales surge was six months after that debut.

Desktop Macs are less common than other models

Macs generate substantial revenue from a smaller user base that upgrades less often and tends to buy higher-end models.

Services tie the ecosystem together

Apple has shifted focus toward subscription services that strengthen the ecosystem without requiring three separate devices. Services revenue reached $26.66 billion in the second quarter of 2025, exceeding total Mac hardware revenue and setting a new company record.

With offerings like iCloud, Apple One, and Apple Music, customers can remain deeply integrated into Apple’s ecosystem with just an iPhone, or an iPhone and iPad combination.

These services keep users connected across devices, generate recurring revenue, and offer features like syncing and shared access that used to require owning a Mac.

Unlike Google’s Android ecosystem or Microsoft’s Windows PC model, Apple’s services play a more central role in binding its hardware platforms together.

The three-device model was never typical

Apple long promoted an ecosystem built around owning a Mac, an iPhone, and an iPad. But in practice, and outside of the AppleInsider audience, that trio has never been standard for most customers.

The iPhone remains the mainstay, while the Mac caters to a smaller, higher-value segment. Apple’s ecosystem fits how people actually use its products, often with just two devices and a growing cloud service layer.