Mac shipments jumped in 2025

New shipment estimates by supply chain analysts suggest that Apple may have gained computing marketshare in the first quarter of 2025, but the report ignores that shipments aren’t sales, and Apple stuffed the channel with hardware ahead of tariff impacts.

Apple entered 2025 with faster shipment growth than rivals, with Mac shipments jumping 28.7%. Rivals HP, Dell and Lenovo managed only single-digit growth, according to Canalys data released on July 1.

Apple shipped roughly 2.7 million desktops and notebooks, raising its share of the U.S. PC shipment market to about 16%, up from just over 14% a year earlier in 2024. These figures measure what Apple sent into retail channels, not how many Macs were actually bought by end users.

Total PC shipments reached 16.9 million units. That rise of nearly 15% year over year reflects how vendors rushed inventory into U.S. channels before tariffs on Chinese-made PCs and components took effect.

The strategy helped vendors lock in lower import costs but risks leaving shelves and warehouses stocked with unsold units.

Apple’s launch of new MacBook Air models with M4 chips in March played a major role in its strong shipment quarter. The updated design, improved performance and lower entry price made the notebook more appealing to students and professionals.

A simultaneous Mac Studio refresh also drew in creative users, supporting Apple’s efforts to push more hardware into stores ahead of tariff changes.

Inventory strategies inflate short-term numbers

Vendors, Apple included, front-loaded shipments early in 2025 to sidestep higher tariff costs, leading to fuller retail inventories. While that move boosted first-quarter shipment numbers, it doesn’t guarantee that these machines quickly reached paying customers.

In Apple’s case, we already know that they did not.

Analysts see the approach as a short-term boost with long-term consequences. Retailers now face the challenge of clearing existing stock before placing new orders, potentially limiting shipments in later quarters.

Apple is well positioned for this, though. The next Mac releases are expected in October or November of 2025. This means what they imported ahead of increased tariffs are still viable products for sale through most of the year and the back-to-school buying season which has already started.

Apple outpaced rivals in shipment growth. Image credit: Canalys

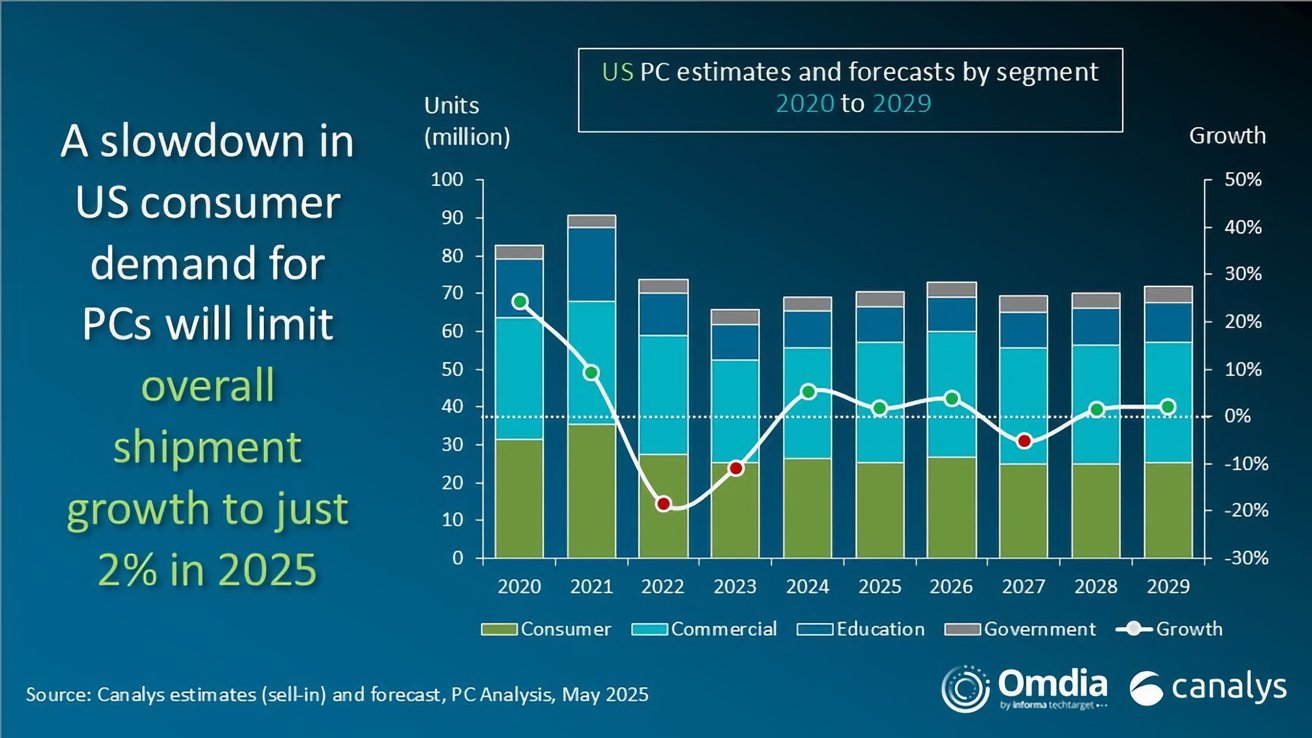

Canalys forecasts just 2% growth in total U.S. PC shipments for all of 2025. This suggests a sharp slowdown in shipments, as you’d expect given the reason for the surge, after Q1.

Commercial demand offers a stabilizing force

Business spending gives only partial relief in a market under pressure. Canalys projects commercial PC shipments will rise 8% in 2025. But that’s not enough to make up for an expected drop of more than 4% in consumer shipments.

The gap raises concerns that even healthy business demand won’t fully steady the market if shoppers keep holding back.

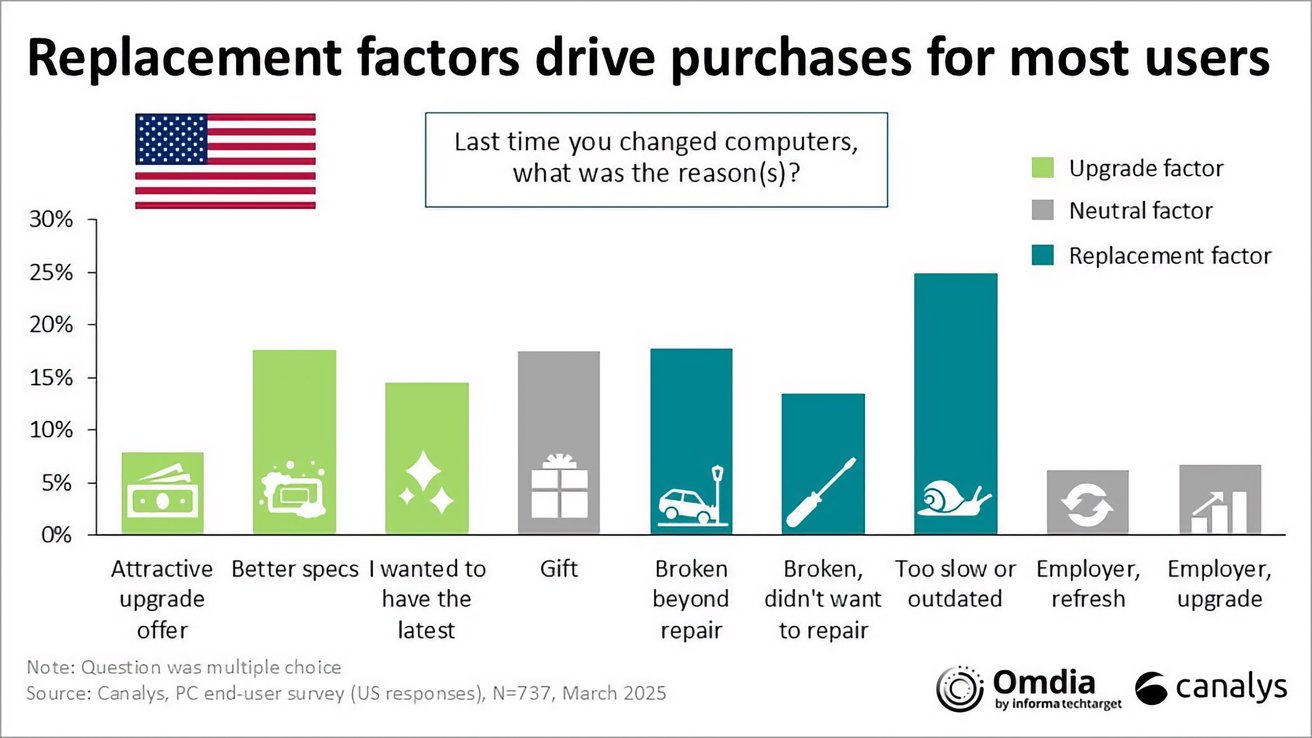

Businesses see PCs as essential work tools, while shoppers often hold off on buying until their machines fail or feel too slow. High prices, confusing specs, and unclear marketing can all discourage upgrades, especially when retailers are working through excess inventory.

Apple’s market approach and broader implications

Apple’s strong shipment quarter reflects both real interest in its new Macs and a clear push to get inventory in place before tariffs raised costs. The company benefits from loyal customers, polished hardware design, and tight integration with its broader ecosystem.

Apple’s strong shipment quarter mixes demand with strategy. Image credit: Canalys

Macs are popular among professionals, students, and creatives who prioritize performance and design. The macOS integration with iCloud, iPhone, and iPad further enhances its appeal and contributes to its sales.

However, those gains don’t guarantee consistent demand. Apple still needs to convert its stocked inventory into actual sales.