The success of investors’ stock market portfolios is increasingly dependent on how they vote, new research has found.

Americans are increasingly buying and selling stocks based on their political associations with profound consequences for their portfolios.

There is currently a 47 percentage point gap between Republicans thinking stocks will rise in the next six months compared to their more bearish Democrat peers.

Meanwhile Democrats who expect stocks to fall over the next six months exceed Republicans by 59 percentage points.

It is the largest sentiment gap on the stock market’s trajectory since 2001, according to Gallup data.

This ‘optimism’ gap is leading both political persuasions to make different trading decisions.

Wealthy individuals who voted red or blue are also increasingly buying different stocks, The Wall Street Journal reported.

Investors who lean towards the Democrats are selling off American assets, fearful that Trump’s policies are going to tank the stock market. However those who voted for the Republicans, and are more optimistic about the market’s chances, are buying or sticking with American companies.

Buying and selling based on political beliefs can be disastrous.

For example, those who sold as Trump’s ‘Liberation Day’ tariff announcements sent stocks on a 20 percent plunge would have lost out on a full recovery to all-time highs.

The long-term consequences can be even more dramatic.

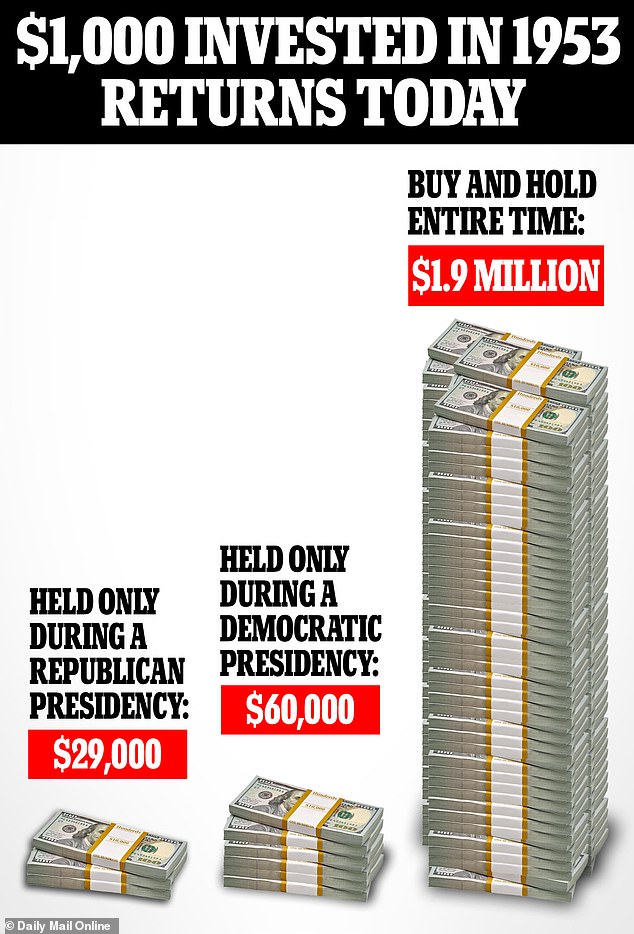

Investing $1,000 in 1953 but only holding stock when a Republican was president would yield $29,000 today, according to Paul Hickey at Bespoke Investment Group.

Doing the same but only investing when a Democrat was in the White House would roughly double the sum.

However, neither strategy would beat simply buying and holding throughout the entire period, which would leave the investor with $1.9 million today.

The divide between Red and Blue voters’ portfolios began in 2013 under Barack Obama’s presidency.

The gap continued to widen in the following years following Trump’s election in 2016, according to Elena Pikulina who collected and studied data from more than 300 independent investment advisers.

Americans are increasingly making investment decisions based on their political persuasion

Some Americans are looking to pull all of their assets out of the US

Others are convinced the stock market will thrive under Trump’s administration

Financial advisor David Sadkin says his clients’ stock market views depend on who they voted for

Trump’s ‘Liberation Day’ tariffs sent stocks nose-diving, but they have since recovered

‘If I know how people voted, I could tell you how they feel about the stock market,’ David Sadkin, partner at Bel Air Investment Advisors, told the Journal.

Sadkin recalled how one of his wealthy clients, who do not approve of the President, inquired about moving all their assets abroad because they were afraid they would sink under Trump’s second term.

On the other hand, Trump voter Bruce Besten, 68, told the Journal that he believes his investments will do well under the current administration.

‘In general, when a person with his mindset is in office, it’s good for the business environment,’ the restaurant owner from Louisville, Kentucky explained.

‘What’s good for the business environment is good for the stock market.’

He told the outlet that media ‘hype’ about how tariffs would batter the economy created buying opportunities for him during the market collapse in April, when he bought American stocks including Nvidia.